Business Equity for Entrepreneurs

Table of Contents

Hey there...

Financing a small business is no easy feat. We’ve been there and we understand!

Bootstrapping is awesome if you can swing it, but no matter what, you’ll need a little money to turn your idea into something tangible.

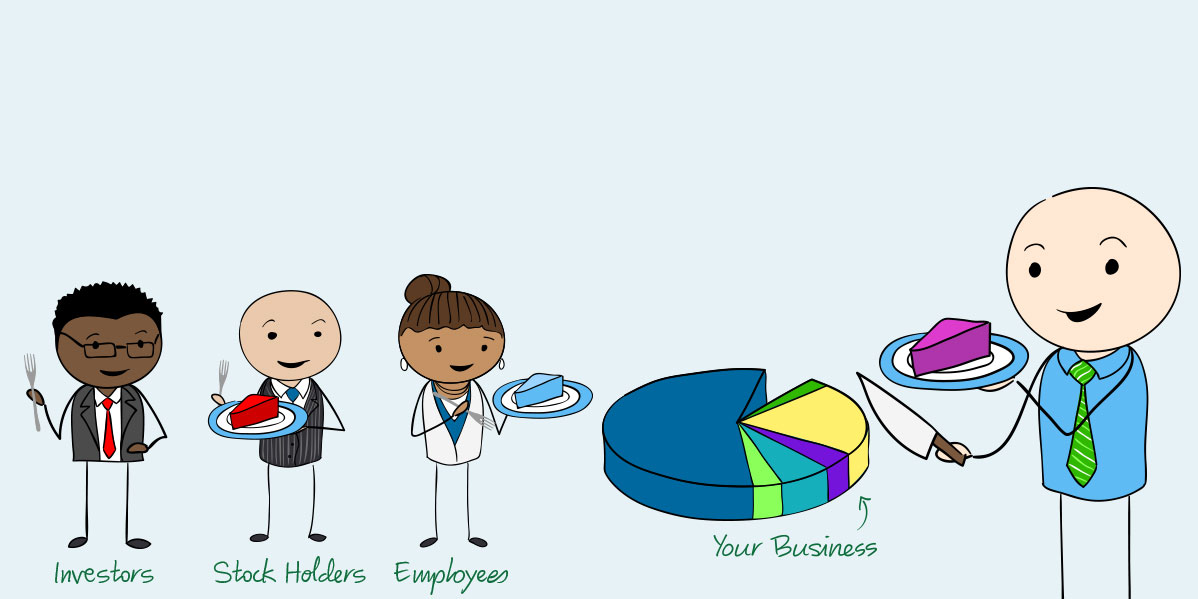

If the money isn’t rolling in yet, it’s tough to build a top notch product or service. That’s why many small businesses and startups offer equity to employees and investors.

Even if outside investors aren’t for you, you might be interested in offering equity to your employees.

But, how do you do it? We put this guide together because we know it’s tough to get started. So if you run a small business or startup and are thinking about making an equity offering, stick with us for an overview of all your options.

What is Equity & is it Right for You?

If you have a great business idea but not enough cash to fund it, equity may be the solution for you. The two most common types of equity are:

- Equity financing: Selling "shares" of your business to outside investors in order to finance your business.

- Equity compensation: Offering employees a percentage of company profits in exchange for lower (or zero) salaries upfront.

Debt financing is also another option to get your startup off the ground. Debt financing is when you get a loan from the bank or private investor that you must eventually pay back. Each option has its pros and cons so be sure to review them in this guide before you make any decisions.

If you've decided equity is right for you, your next step will be to search for investors: friends, family, business contacts, or even angel investors and venture capitalists. Networks such as Kickstarter allow you to post your business plan and wait for investors to come to you. This setup is great because it allows a lot of people to invest in your project, and not one major investor.

Putting Everything Together

When you've got the funds you need, your next search should be for legal counsel. Lawyers may be expensive but you'll be happy to have one when it comes time to negotiating a fair equity arrangement with investors and employees.

It can be tough to pay employees what they want in the beginning stages of your business. So if you're considering equity compensation, it's good to consult a lawyer for working out terms to ensure everyone is happy.

Listen up, employees! If you've been offered equity-based pay, deciding whether or not it's for you can be tough. That's why it's essential you run a risk assessment. In the guide, we explain more on what you should measure so you don't get yourself into trouble.

Taking the Next Step

This guide will go into more detail on what equity is and what you need to know when approaching investors and lawyers. It will also help you and employees understand your options. Don't let the lack of funds slow your dream down. Learn about the various equity types and take the next step!

Grasshopper provides 800 and toll free numbers as well as local phone numbers for businesses and allows them to use a virtual phone system to keep their employees connected anywhere, on any phone with features like call forwarding.