Financial Terms

- Lesson Materials Financial Terms Handout

- Completion time About 20 minutes

Unless you're starting a business in the finance industry, you're probably not familiar with all the financial terms used in running a business. But by the end of this lesson, you'll be fluent in the art of speaking financials.

In this lesson, you'll learn important financial terms used throughout the rest of your course and where you might need to apply these terms in a business setting.

Budgeting Terms

Whether you're starting your business or running one, estimating budgets and understanding expenses is crucial to ensuring your business stays afloat. The following terms will be helpful for you in understanding costs for putting your budget together.

- Total startup cost: The cost needed before a business is able to get started

- Day-to-day operational cost: Cost reserved for funding daily operations Example: Utilities

- Fixed expense: An expense that remains a fixed price regardless of business performance Example: Health Insurance

- Variable expense: An expense that changes in relation to production volume or business activity Example: Sales commissions

- Semi variable expense: A fixed cost that can change depending on business volume Example: Telecommunications

- Capital costs: One-time setup expense Example: New computers

- Seed money: Money allocated to initiate a project

For information on putting your budget together, head to Brainstorming Your Business Budget.

Profit Terms

When you're in a room full of investors, with the end goal for them to support your business idea, showing them that your business can generate profit is huge. In order to do that, you'll need to use a few financial buzz terms.

The following financial terms are helpful for discussing your business' value:

- Revenue: Amount of money earned through a sale

- Profit: Revenue – Cost = Profit

- Capital: Money invested in a business to build revenue

- Cash flow: Money being transferred in and out of your business

In addition to the terms listed above, break-even point is important to understand as well. A break-even point is the point at which revenue and operational costs even out. A break-even analysis is important for investors because it tells them when they can expect to see a profit. In order to run a breakeven analysis, you'll need to first identify your startup costs, projected revenue, fixed, and variable costs.

As you review these terms, you'll notice that the key theme in each is monetary growth. And that's exactly what investors want to see. That you can clearly demonstrate how you anticipate your business to grow – not overnight, but over the course of several months to a year.

Financial Statements

Whether you're prepping your business plan or keeping monthly tabs on your financials, there are three financial statements you'll report on quarterly and annually. We discuss them below.

Monthly Budget and Cash Flow Statement

As previously mentioned, a cash flow statement explains how much money is flowing in and out of your business. It depicts how much money you're bringing in, in addition, to how much is going out due to expenses and operational costs.

As a result, preparing a monthly budget or cash flow statement demonstrates that you know exactly how much your business will spend and earn, which is important for making payments on loans for instance. More importantly, it also shows investors that you plan to keep to a budget; you're not negligent and won't overspend (their) money.

Be prepared to include your operational costs, fixed expenses, projected revenue, and profit. For startups, a cash-flow projection can be broken down into 12 months because you're making educated estimates.

Balance Sheet

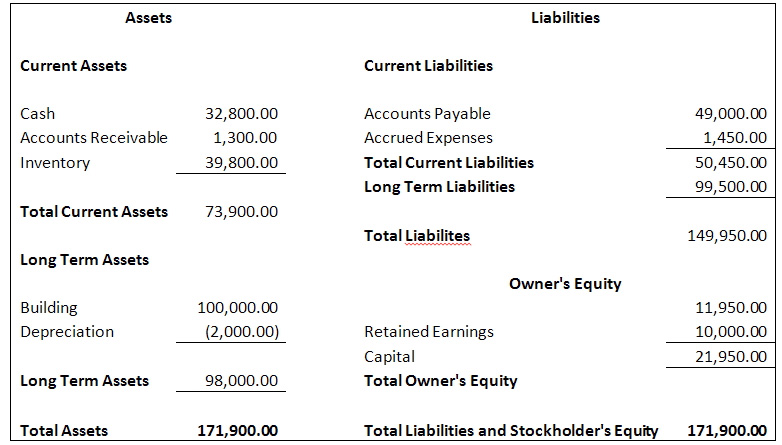

The balance sheet shows what the assets a company owns and how they are financed; either through debt (liabilities) or investment from the owners (owner’s equity). The total value of liabilities and owner’s equity will always equal the value of the assets.

We explain these terms in more depth below:

- Assets are the resources a business owns or acquire through transactions, such as investments, property, and equipment.

- Current Assets are assets that are expected to be used up within one year. For instance: cash, inventory, and prepaid insurance.

- Liabilities are the amounts owed to creditors for past transactions. There are two types:

- Current Liabilities are expected to be paid off within one year, such as accounts payable and short-term loans.

- Long Term Liabilities are due more than one year from the reporting date, such as long term debt and less depreciation.

- Owner's Equity is the source of the company's assets. There are two categories:

- Paid in Capital: Money shareholders put into the business.

- Retained Earnings: A company’s net income or less from in inception to the balance sheet date.

Below is an example of a balance sheet:

Profit and Loss Statement (P&L)

Also known as an income statement, a profit and loss statement details revenue and expenses over a period of time. Investors want this information in order to make decisions; either on reducing costs or figuring out ways to increase revenue.

Below is an example of a profit and loss statement:

| Revenue | $1,000 |

| Expenses | -- |

| Salaries | 300 |

| Utilities | 100 |

| Insurance | 50 |

| Tax Expense | 50 |

| Administrative Expense | 10 |

| Net Income | $490 |

Having control of your financials is essential and the only way you'll be able to make confident business decisions. Having a budget and sticking to it will also ensure you have money for future projects and can make payments on time.

Strengthen your financial knowledge by downloading the Financial Terms Cheat Sheet below so you spend more time on your business and less time with your head in a dictionary.

- Lesson Materials Financial Terms Handout

Talk about this lesson