How to Choose the Best Financing for Your Business

Presented by Grasshopper Academy

Hosted by

How to Choose the Best Financing for Your Business

Finances are a perpetual adventure for entrepreneurs and small business owners. From the very beginning you have to decide whether to pursue investors, take out loans, or bootstrap your dreams, but it doesn’t end there.

Good times will make a small business owner wonder if they need to get more funding: growth demands new equipment or more space, big sales can create a cash flow shortage while you wait for invoice payments, etc.

Hard times can also bring financing back into business conversations: sales are down, seasonality has affected business, or maybe equipment needs replacing yesterday.

If you’re considering whether your business needs financing, take it one step at a time:

- First, make sure you really need funding.

- Decide which type of funding is best for you and your company.

- Secure what you need to keep growing.

Do I Really Need Funding?

Every entrepreneur or small business owner could use more money, but "financing" is not really the same thing as “funds.” There’s no such thing as free money, so it’s crucial to first determine if the business really needs financing.

There are a few situations that really do call for funding:

- Short-term cash flow shortages

- Large purchases that will create new growth

- Emergencies

1. Cash Flow Shortages

Sometimes the income and expenses just aren’t timed well. You have to pay employees every two weeks, for example, but customers have 30 days to pay invoices. If your business is growing and healthy, it’s okay to get financing to cover a short-term cash flow shortage. If your business is struggling, though, don’t seek out financing as a stop-gap measure. It’s never enough.

If you need cash because your sales are skyrocketing, go for it. If you need cash because your sales are in the toilet, focus on fixing the real problem: sales!David Worrell — FUSE Financial Partners

Getting additional capital can be a great way to grow faster, but do not pursue funding if the business is not doing well. Taking out loans if the business is in trouble will only make the financials worse.Andrea Travillian — Smart Step

2. Large Purchases

Sometimes you have to spend money to make money, but, similar to cash flow shortages, only take this step to advance growth—not to make up for other failures or shortcomings. As your business grows, you may eventually need new equipment, larger facilities, etc. Or you may get an opportunity to purchase another business. As long as your business is healthy and the purchase will drive growth, go for it.

Purchasing a building, equipment, large tools, and other physical property that lasts more than a few years is a mid-term to long-term capital need, and is best managed with a term loan.Holly Magister — Exit Promise

Your financial documentation can help you determine if the business is in a situation that requires (and allows for) financing.

I typically recommend that a business owner follow these reports: cash flow, P&L statements and projections, projected sales. With these, especially the cash flow, they can adequately determine what extra capital they will need to cover both operating expenses and growth projects.Andrea Travillian — Smart Step

Just because you need to make a purchase, doesn’t mean the business can afford the financing to make it happen. Make sure to keep you financial statements up-to-date so they’re always ready to answer your questions.

3. Emergencies

Running a small business is never smooth-sailing. Equipment gets old and breaks down, employees make mistakes, and at some point you will find yourself facing a large purchase that you had not intended on (at least not for a while). If it’s crucial to your business, sometimes outside funding is the only way.

Loans are good for unplanned expenses such as equipment that breaks but is essential to the lifeblood of your business—like a pizza shop whose oven breaks.Cristina Habersetzer — BFS Capital

The Risks of Financing

Even if your business is growing and your situation qualifies for financing, make sure to fully weigh the benefits against the risks.

Anytime you add extra debt to a business it will increase the risk. It increases your overhead expenses, thus requiring you to create more sales to pay for the funding. While it can let your grow to the next level faster, there is typically a delay between paying for the funding and your growth initiatives taking off. This is a very risky time when many businesses fail.Andrea Travillian — Smart Step

People don’t always think about the downstream effects of taking that capital. Imagine failure and see if you still want it. If you can’t live with that down-stream scenario, you probably shouldn’t take that capital. Money does not solve all problems.Mike McDerment — FreshBooks

The specific risks of outside funding depend on the type of financing you choose to pursue. Just as each has unique benefits, each also has unique risks.

- Debt financing risks the collateral you offer to secure a loan, and your personal and/or business credit score if something goes wrong. You will also diminish your overall income to make interest payments.

- Equity funding lowers your revenue stream indefinitely, because you have, effectively, sold part of your business to acquire that funding.

If you are obtaining debt financing, the biggest risk a business faces is if the business is not successful and the owners are on the hook for continuing to pay the loan (via a personal guarantee).— Joshua Lance, CPA

If you get equity funding by selling part of the company to raise money, the lifetime value of that company’s revenue stream to you is permanently diminished.— Brad Hanks ZipBooks

Get Creative, Weigh Your Options

The decision to pursue funding cannot be made lightly, and should only be made when other options are exhausted.

Get creative first. If you have been considering financing for a little while, it gets harder to think outside that box. So imagine, for a moment, that financing is not an option. How might you improve cash flow or find the capital you need for purchases? (Do you really need those purchases?)

If it is a cash flow issue, consider other alternatives such as giving your customers a discount to pay faster. A 10% discount may be cheaper than options such as factoring or even a line of credit if you have bad credit.Andrea Travillian — Smart Step

If necessity is the mother of invention, being in a tight financial situation might just be what you need to shake up your thinking and develop something—a product, service, or even just a business model for your own startup—that takes your business to the next level.

Sometimes not having money readily available keeps you very disciplined within your business. It makes you think deeper about your business, and puts you in a better position to actually go out and get financing at the right time.Raj Sabhlok — Zoho Books

Don’t rush into financing.

What Kind of Financing is Best for My Business?

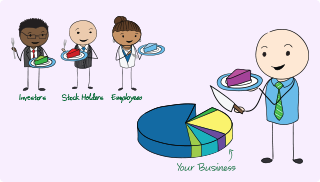

There are a lot of specific financing options for your business, but they all fall into one of two categories:

- Debt financing is borrowing money. You do not surrender any ownership of the company, but these loans often come with strict timeframes for paying back the funds with interest.

- Equity financing sells part of the business to investors. There is no debt to repay, but the business owner’s portion of income—and sometimes, control over the business—is lowered.

Deciding which is best for you will depend on what you are willing to surrender in exchange for the financing, and on what your business has to offer.

A business that is asset-intensive (like a craft brewery) may opt for loans, as they have the ability to use their equipment to secure a loan. A tech startup will opt for outside investors, as this is more of an attractive investment for that type of investor and they don't have the assets to collateralize a loan.— Joshua Lance, CPA

If you and the business don’t have much to offer for collateral, you may need to seek equity investors, regardless of how you feel about surrendering shares of the company. If you do have assets, you have the additional option of a loan.

Small Business Loans

Most lending institutions offer businesses short-term and long-term loans:

- Short-term loans often get funds to the business faster, because they aren’t as restrictive as longer loans from traditional institutions. They are easier to secure, especially for small businesses, although interest rates are, initially, higher than long-term loans.

- Long-term loans spread out the repayment schedule over years. They can be harder to secure, especially for new businesses, because they come through more traditional channels. They do offer the benefit of breaking up repayment of a large loan into manageable payments, and interest rates are lower than short-term loans.

Business loans are also categorized according to how you will use them. A working capital loan give you the money you need for regular expenses and smaller purchases. A business expansion loan provides a large lump sum for large purchases.

The approvals on short-term loans typically take days and the funding is just as quick—plus, they require a lot less paperwork. Short-term loans are not secured with assets. The overall cost of the loan is higher, however, for those businesses who want to pay off their loans quickly, need fast access to funds, or do not qualify under long-term loan terms, short term loans are the best option.— Cristina Habersetzer BFS Capital

Business Line of Credit

A small business line of credit is similar to a credit card; it allows you to borrow funds against a predetermined limit. The benefit, compared to a loan, is that you only pay interest on the money you actually borrow. A business LOC is a good option for entrepreneurs who may be unsure of how much they need.

Crowdfunding

There are a few different models of crowdfunding, and each platform has different specific requirements and conditions. In general, crowdfunding is a great way to validate a product or business idea, and can be helpful for obtaining some initial funding, but it’s rarely a good option for operating expenses or additional investments.

Invoice Factoring

Invoice factoring provides funds for your unpaid invoices. A factoring company will pay the majority of your unpaid invoice as an advance. When your client pays the balance of the invoice, the factor deducts a fee, and pays you the remainder.

If a small business is experiencing cash flow shortages due to a number of unpaid invoices, factoring can be a good way to get some cash quickly.

How do I Actually Get Funding?

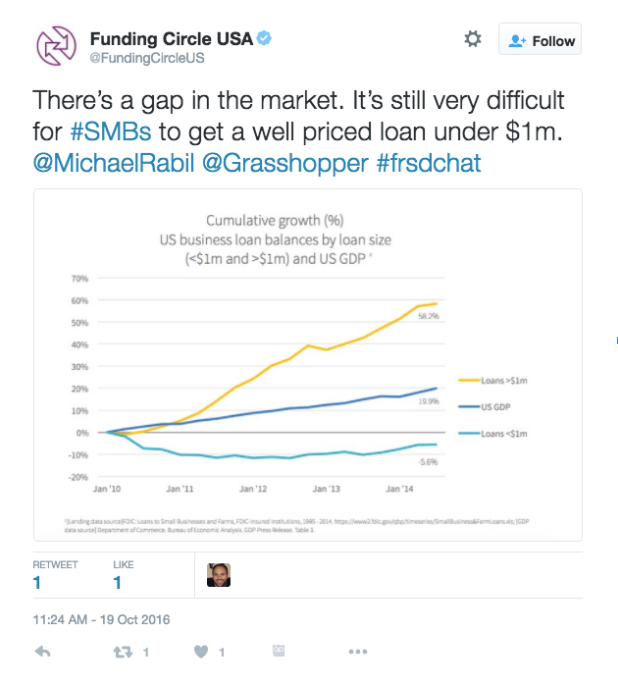

Most small businesses opt for a short-term loan when they need to make up for a cash-flow shortage or make a big purchase. But getting a bank loan for a small business isn’t easy these days.

Banks are lending 20% less than they were before the recession. The only business getting more loans from banks are big, big businesses. There’s a decrease of well-priced capital to SMB owners.— Mike Rabil Funding Circle

Fortunately, there are other options for small business owners today. Lenders like Funding Circle, Accion, and Fundation exist to help entrepreneurs who don’t meet the strict requirements for securing a traditional business loan.

I’m excited about the future of small business financing. This used to be something that was run by the banks, but I believe in choice. There are a lot of new options and people who are faster and easier to work with.— Mike McDerment FreshBooks

Determine Your Ability to Repay a Loan

Before you apply for a business loan, you will need to determine your ability to repay that loan. The lender is going to look at these numbers before they grant the loan, and it’s best to make it part of your loan application package.

Lenders will look at two factors: cash flow and collateral. If you’re preparing to meet with a lender, make sure you can demonstrate the value of your collateral and the health and growth of your business. If you need financing to cover a short-term cash flow shortage, be prepared to show how your business is growing and why there is a temporary shortage.

Lenders will also look for a couple financial ratios:

Banks look at two financial ratios: Your total debt to total equity (which should not be more than 2:1), and your Debt Service Coverage, which is the ratio of monthly Net Operating Profit (EBITDA) to monthly debt payments. That ratio should be better than 1:1.25.— David Worrell FUSE Financial Partners

If you are considering the cost for yourself, to determine whether or not to take a loan, don’t forget to also look at the interest rates and fees:

Look at the fee that you pay on the money you’re taking. You should make this money back by the end of the loan. If, by the end of your loan term, you are flat (because you got out of a debt situation), now own the equipment or inventory that will help bring you more business, or are on your way up, you know you made a good decision.— Cristina Habersetzer BFS Capital

Choose a Lender and Make Sure You Qualify

Deciding what kind of financing best suits your needs and your business will help you choose a lender. Compare services, requirements, and reviews to help decide which specific bank or company to work with.

You’ll also want to make sure you check your credit score before you meet with lenders or apply for online loans. There are several websites that will help you do this, and remember that checking your score does not hurt it.

Gather Documents for the Lender

Different banks and lenders will ask for different documents, but most will want to see a combination of:

- Tax returns (personal and business)

- Bank statements (personal and business)

- Cash flow statement

- P&L report

- Sales projections

- Legal business documents

A loan is a risk for any lender, so make sure you have your ducks in a row before you contact anyone.

Looking Forward: The Future of Small Business Funding and Your Business’ Needs

Financing is an ongoing project for any business, especially the small ones. Some business owners wonder about hiring a funding strategist, but this step isn’t usually necessary.

A VP of Finance, CFO, or controller should have that in his/her wheelhouse. There are also really good brokers or referral partners who can be that resource for you, and take that out of your workflow. Sometimes accountants or CPAs can do it as well. It doesn’t need to be a full-time hire.— Mike Rabil Funding Circle

Additionally, especially for small business, it’s not even necessarily what’s best for the business.

People lend money to people they like. The business owner should be the one out there shaking hands and telling their story.— Melani GordonTapHunter

Entrepreneurs are very much the face of their businesses, and it’s your passion and vision that sells the business—to investors as well as to customers and buyers.

And the personal connection is two-way. Not only do lenders want to know the people they are investing in, small business owners need to know the lenders they are partnering with.

Borrowing money is a partnership. Really understand who the lender or investor is. You want to know the lender is going to be around for a long time.— Mike Rabil Funding Circle

It’s a great time to be an entrepreneur for a lot of reasons, and the democratization of small business financing is one of them.

I just think it’s a really exciting time for small business and entrepreneurs.— Melani Gordon TapHunter

If your business is healthy, and you just need a little boost to keep things moving forward, start exploring your financing options. Small business owners today have an unprecedented number of options and lenders. Explore your options, proceed with caution, and grow the business of your dreams.

Other Resources to Help You Grow Your Business

Meet the Panelists

-

Melani Gordon – Co-Founder & CEO - TapHunter

Melani Gordon As Co-Founder and CEO of TapHunter, Melani Gordon’s innate leadership, entrepreneurial spirit and ultimate passion for all things craft and premium beverage has quickly made her a sought-after industry influencer.

With more than 14 years of marketing and sales expertise, and having held senior roles at a variety of high-tech and startup firms, Melani leverages her extensive background in new media and marketing strategy to support the vision and success of TapHunter every day.

Connect with MelaniMelani's Website Melani on Twitter

-

Raj Sabhlok – President - ManageEngine & Zoho.com

Raj Sabhlok Raj Sabhlok is the president of ManageEngine and Zoho.com, both divisions of Zoho Corp. Raj has particular expertise in IT infrastructure management and business software. At Zoho, Raj is focused on delivering disruptive software solutions for customers by leveraging fresh technologies and innovative business models.

Raj previously spent nearly 20 years working with some of the world’s most dynamic technology companies including Embarcadero Technologies, BMC Software and The Santa Cruz Operation (SCO).

Connect with RajRaj Sabhlok's Website Raj Sabhlok on Twitter

-

Mike McDerment – Co-Founder & CEO - Freshbooks

Mike McDerment Mike McDerment is the co-founder and CEO of FreshBooks, planet earth’s #1 cloud accounting solution designed for small business owners. In 2003, Mike built FreshBooks for his design firm, scratched his own itch, then moved into his parent’s basement for 3.5 years to get FreshBooks off the ground. Since then over 5,000,000 people have used FreshBooks to save time billing and collect billions of dollars.

Mike and his team dedicate themselves to executing extraordinary experiences everyday for small business owners who want to focus on the work they love, instead of on their paperwork.

Connect with MikeMike's Website Mike on Twitter

-

Mike Rabil – VP of Sales & Partnerships - Funding Circle

Mike Rabil Mike leads Funding Circle’s sales and partnerships teams, focusing on attracting high quality small business borrowers and strategic partners to the platform. Before Funding Circle, Mike was a co-founder of Endurance Companies, where he built a series of franchise gyms, which spurred the original idea for Funding Circle in the US.

Mike also founded a high growth fitness concept in Boston called Turnstyle Cycle and worked in the Corporate Finance Group at Jones Lang LaSalle, the largest global commercial real estate services firm.

Connect with MikeMike's Website Mike on Twitter

Want us to let you know when the next Fireside Chat is going to happen? Be notified of upcoming online events »

Want to see other topics we’ve chatted with experts about? View previous online event resources »

Looks like there was an issue with your RSVP!

Please try again. If it still doesn’t work, email it to us at firesidechat@grasshopper.com.

×Thanks for RSVPing for our event!

Submit any questions you may have for the panelists on Twitter to @grasshopper and use the hash tag #frsdchat - or email questions directly to firesidechat@grasshopper.com.

Be sure to share the event details with your friends and colleagues on social media.

Share this page ×

JUMP: The Ultimate Guide to Starting and Growing Your Business

JUMP: The Ultimate Guide to Starting and Growing Your Business Grow Local: The Complete Guide to Growing a Local Business

Grow Local: The Complete Guide to Growing a Local Business Business Equity for Entrepreneurs

Business Equity for Entrepreneurs Find the Best Online Payment Solution

Find the Best Online Payment Solution Choose the Right Colors for Your Brand

Choose the Right Colors for Your Brand