It’s no secret that we live in a time of big change all the time, and 2016 is no different. As a small business owner, it’s important to keep track of key changes in policy and taxes and how they might affect your business.

We’ve rounded up some of the bigger changes the new year is bringing. They’re must-know changes for small business owners all over, so grab a coffee and get comfy.

Taxes

Research & Development Credit

R&D tax credits have been around for several years. You don’t have to have your own lab or conduct ground-breaking research to qualify. Any business that employs engineers or outsources product testing is eligible, so startups should take note.

The credits were extended for 2016, but also included one substantial tweak to the original: the credit can be used against payroll taxes. Prior to this change, any R&D credit had to be applied to tax liability ─ many startups don’t have any tax liability.

As of 2016, you can claim R&D credit to lower your payroll taxes, which means a lot more small businesses will find it worthwhile to claim.

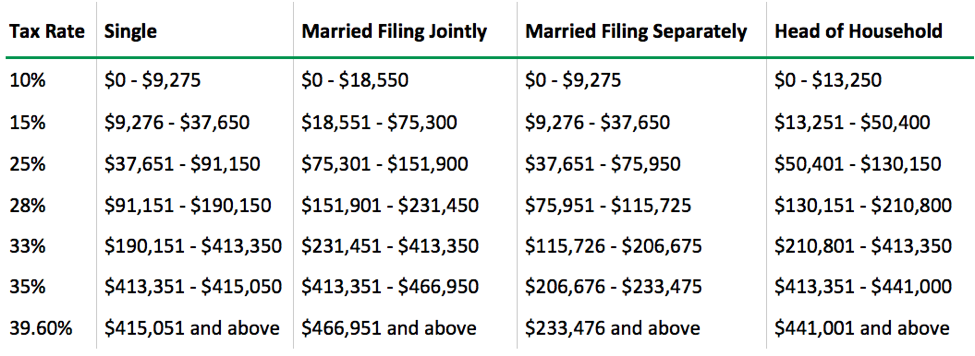

New Income Tax Brackets

Income tax brackets changed in a big way in 2015, adding a seventh bracket. Nothing that significant is happening this year, but the brackets are being adjusted, so it’s important to be aware of. Here’s what they’ll look like for 2016:

Affordable Care Act Changes

Definition of a Small Employer

Previously, a small business was considered a small employer (SE) if it employed less than 100 full-time employees. In 2016, an SE is permanently defined as having 0 - 50 employees. The PACE Act, which made this distinction, allows individual states to expand the category to businesses with 51-99 full-time employees. That means if you fall into that bracket, you’ll need to check with your state’s rules on whether or not you’re considered a small employer.

Penalties for Minimum Coverage

In 2015, an employer could avoid paying a fee if at least 70% of their workforce was provided the minimum essential coverage. To avoid a penalty in 2016, 95% of employees must be provided the minimum essential coverage.

Dependent Coverage

Employers were only required to offer coverage for employees in 2015. This year, businesses must provide minimum essential coverage to both employees and their eligible dependents.

Mandatory Information Returns

Both small and large employers must file information returns to employees and the government. The deadline to provide copies to employees is January 31st and companies have until February 28th to file with the IRS.

Minimum Wage

No surprise here ─ minimum wages are increasing in 17 states across the country. Minimums are increasing from as little as $0.05 to as much as $2 an hour. This brings the national high to $11.50 (Washington, D.C.) Minimum wages increased as of January 1st in 14 states, with 2 others and Washington, D.C. changing in July and August.

States increasing the minimum wage include: Alaska, Arkansas, California, Colorado, Connecticut, Hawaii, Maryland, Massachusetts, Michigan, Minnesota, Nebraska, New York, Rhode Island, South Dakota, Vermont, Washington D.C., and West Virginia.

Employers in these states will need to take a look at their existing payscales and adjust accordingly. Don’t forget, not only minimum wage earners will see an increase ─ it’s good practice to bump pay for hourly employees making more than the minimum wage, as well.

Minimum wage increases may seem like a drag, but higher pay increases employee satisfaction and leads to reduced turnover in the long term. The increases are also expected to inject more than $1 billion into the national economy. And that’s great for small biz.

You’re Officially Up-to-Date

Part of being a small business owner means staying current on plenty of laws and regulations. There are a lot changes coming our way, but now that you’ve gotten the most essential updates, you’re ready to dive into 2016.

For insight on what to expect in the coming year, check out Marketing Trends to Plan for in 2016.