If you screw up your taxes, it's not going to be pretty.

The nuts and bolts of business are a little boring, but taking note of changes can spell out the future of your business.

Now that it's 2015, there are a few things you need to know.

We pulled together the most important, must-know information that you’ll need in order to be ready for the upcoming year. Here you go!

Taxes

2014 was a year of change, and your 2014 - 2015 taxes will be no exception. If one of your many hats includes tax accountant, here’s what you need to know before you take a look at filing in 2015.

New Income Tax Brackets

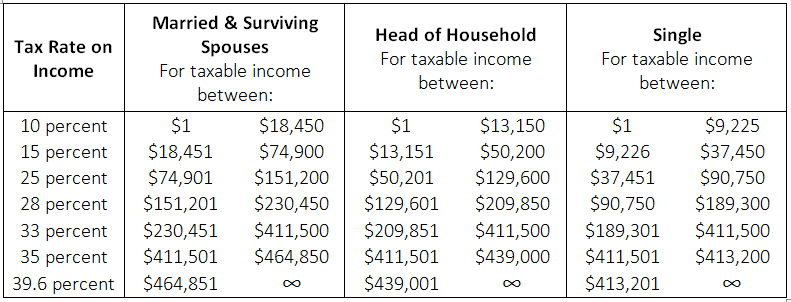

New in 2015: there are now seven income tax brackets. They’ll also break down differently, but still depend on your filing status. The new breakdown looks like this:

Capital Gains Taxes Expand

Capital gains are derived from any profits you earn by selling capital assets – which include investments and property. If you previously held the investment or property for less than one year, any gains just get lumped in with your regular yearly income.

Gains on assets held for more than one year are treated a little differently, depending on what bracket you fall into. The good news is if you’re in the 10 or 15 percent brackets, you won’t need to pay any capital gains taxes. Those in the 25, 28, 33, and 35 percent brackets pay 15% capital gains taxes and those in the 39.6 percent bracket will pay 20%.

Some other important stuff:

-

Earnings from ordinary dividend payments are included and taxed with your regular income

-

Any profit from qualified dividend payments is considered long-term capital gains

-

The Net Investment income tax is 3.8%, which includes income from capital gains

Payroll Taxes Increase

This will affect just about everyone – standard payroll taxes (FICA) are increasing for 2015 tax season.

-

Social Security tax is now 12.4% on earnings up to $118,500

-

Medicare tax will be 2.9% on all income

-

Additional Medicare tax becomes 0.9% on income above $200,000 (if filing as single or head of household), $125,000 (if married and filing separately), and $250,000 (if married and filing jointly)

As a small business owner, you’re still responsible for the entirety of payroll taxes on your own income. If you have employees, you’ll still be paying half of the payroll taxes on their incomes.

Changes to Retirement Account Contributions

Retirement accounts are also changing this year. In most cases, you can put away a lot more toward retirement than in previous years.

-

SEP-IRA and solo 401(k): As a small business owner, you’re probably using one of these two types of retirement accounts. Your maximum contribution is now increasing to $53,000 per year.

-

SIMPLE IRA: Your contribution limit is increasing to $12,500. However, anyone aged 50 or older as of December 31st, 2015 can contribute up to an additional $3,000 to “catch up.”

-

401(k): Ordinary employees can contribute up to $18,000 with those aged 50 or older being allowed an additional $6,000 in “catch up” contributions.

-

IRA: This one is staying constant at a limit of $5,500 but allows for an additional $1,000 to “catch up.”

Health Insurance

The open enrollment deadline for individuals to sign up and select healthcare plans is February 15, 2015. Small businesses can start this process at any time, but must choose by the February 15 deadline.

Despite the initial problems, signing up for healthcare at Healthcare.gov has gotten much easier and more effective. However, this means the penalties for going without health insurance have gone up quite a bit, as well. For 2015, the penalty is the higher of 2% of your income or $325/adult and $162.50/child.

As before, small businesses with fewer than fifty full-time employees are still not required to provide health insurance to their employees. However, there are tax credits and incentives for those that do. For those small businesses with 25 or fewer full-time employees, you can get a credit for up to 50% of the contribution you make toward your employees’ premiums.

The smaller the business, the larger the tax credit, with the biggest credit going to businesses with less than 10 employees making an average of $25,000 or less. You can take a look at the Small Business Health Options Program (SHOP), if you’re thinking about offering health insurance to your employees.

Minimum Wage

As of January 1st, 2015, minimum wage increased in 21 states including New York, Colorado, and Florida. Some states increased the minimum wage by up to $1/hour, which brings the national average to $8 with a high of $9.15.

States increasing: Massachusetts, New York, Florida, Colorado, Connecticut, Maryland, Ohio, West Virginia, Washington, Oregon, Montana, South Dakota, Nebraska, Arizona, Minnesota, Missouri, Arkansas, Vermont, Rhode Island, New Jersey, and Delaware.

If you or your employees are working in any of these states, you’ll need to take a look at your pay scales and increase where needed. For hourly employees who are making more than minimum wage, it’s usually good practice to increase their pay relative to the new minimum, too.

Despite the increase in your payroll costs, the higher wages will help you reduce turnover and generally increase employee satisfaction, at least in the short-term. The increases are expected to pump about $1.5 billion into our economy, which is also super for small businesses.

New Trends

Mobile

No shocker here – mobile is still getting bigger. As of Friday, January 9th, mobile accounted for 60% of the time people spend on websites. That means that over half the people viewing your business site are doing it from some kind of mobile device.

With numbers like that, you can’t afford to ignore mobile anymore. It’s likely to continue growing, so it’s officially time to hop on the mobile optimization bandwagon.

Planning some changes to your website? Implement them with mobile in mind and be sure you’re using responsive designs. Don’t forget: most website building platforms – like Wordpress, Squarespace, and Wix – have a simple option to allow for mobile optimization. Just check it! If you can swing it, a mobile app is always a good idea, too.

Another important number: 20%. Of all the time spent on mobile devices, 20% is spent on Facebook. That means you need a company Facebook page, at the bare minimum. You should also want to look into ads and sponsored posts if it works for your business.

Content

This one’s not new. We’ve been talking about content for a while now, and it’s not going away. So if you thought it was a fad or that it wouldn’t help your business, it’s time to rethink it.

Every week, marketing shifts even more from product-focused to customer-focused. That means content is becoming even more important as a way to support your customers and add even more value to what you offer.

If you’re thinking you can’t afford content, think again. As more companies and professionals jump into the market, it’s becoming even more affordable to take on a content orientation. Not to mention that content marketing is a good way to get the most bang out of your marketing budget, no matter how tight.

Competition in Recruiting

As the economy continues to rebound, the job market promises to become a little less cutthroat. The increase in minimum wage and falling unemployment rate will combine to make recruiting top talent much more competitive. That means it’s gonna be a bit harder to attract top talent to your small business this year.

But small business doesn’t mean settling for small talent, so don’t be afraid to compete with the big guys in 2015. A good way to have a competitive job offer in 2015 is to pay about 10 percent more for each team member. You should also plan to invest a lot more in career training to keep employee turnover low and foster loyalty from new hires.

Smartphone Payment

With the launch of Apple Pay in late 2014, the mobile wallet market has really taken off. Within the first 17 days after its release, Whole Foods processed 150,000 Apple Pay transactions. That’s kind of a big deal. When you add other competing services like Google Wallet, PayPal, Square, and Bitcoin, it’s a huge market.

All signs point to tremendous additional growth in 2015, so it’s time to start thinking about near field communication systems and mobile point-of-sale devices. In the very near future, having the capability to accept smartphone payments will likely be as crucial as accepting credit and debit cards is today.

Now You Know

That’s what’s up in 2015. After a year full of big progress, big change, and big innovation, there’s a whole lot of new going on in the new year. Now that you know what’s super important, you’re ready for a successful 2015!

How are you preparing your business for 2015?