It’s a new year, and while that means celebrations, new plans, new goals, and resolutions — it also means new work.

After all, as any small business owner knows, there’s only one constant in life: change.

Technically, actually there are three constants in life — death, taxes, and change. But in this summation of changes for 2017, we’ll focus on the latter two constants.

Tax Deadline Changes (Depending on Your Company Type)

The tax world rests on deadlines, and that’s no different now. What’s changing in 2017 are some pretty important deadlines — and you’ll want to mark your calendar sooner rather than later.

Business News Daily notes that the deadlines for C corporations have been moved to April 15th from March 15th. That leaves some more wiggle room. But partnerships and S corporations were moved up a month, now landing on March 15th.

Even individuals filing tax returns should note a change this year, as April 15th is Emancipation Day. The filing deadline for individuals is now April 18th, 2017, which gives you a few extra days to prepare.

To make sense of it all, visit eFile for individual returns and The Balance for partnership and company returns. You’ll have to do a bit of scrolling to find the relevant 2017 dates, but it’s worth it to know that you’re making all of the right filings on time.

If you’re interested in finding more tax resources from the most direct source there is, make sure that you check out the IRS Small Business and Self-Employed Tax Center.

Reimbursing Employees for Health Costs

This doesn’t effect your 2016 taxes, but is something to be aware of for 2017: reimbursing employees for health care costs.

As of January 1st of this year, employers can offer QSEHRAs, or Qualified Small Employer Health Reimbursement Arrangements — without drawing Obamacare penalties. As Nola notes, “Under these new plans, an eligible small business can reimburse an employee’s individually purchased health insurance and other deductible medical costs of up to $4,950 per year for an individual and up to $10,000 for a family.”

There are a few rules to ensure an employee qualifies for this kind of reimbursement, however, including these requirements:

-

25 years old and older

-

Full-time employees

-

Completed 90 days of service

It’s worth noting that these QSEHSA’s are not meant to be used only for employers; in fact, it cannot be used by sole proprietors, partners, LLC members, or anyone owning more than 2% in an S-Corp. As these people don’t qualify as employees, Nola notes, they don’t qualify for an employee benefit arrangement of this type.

If you’re self-employed, however, chances are you’re accustomed to these stipulations.

Adjustment in Income Tax for Inflation

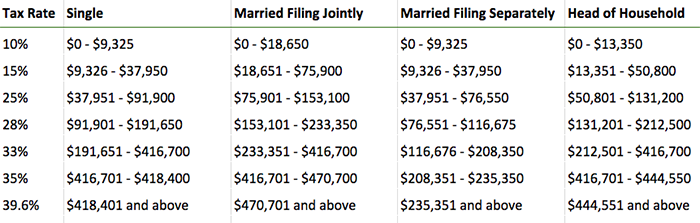

2017’s tax brackets will look a bit different than 2016’s — and that’s by design. The IRS adjusts these brackets for inflation.

If you look at the table, you’ll notice that the brackets haven’t changed a whole lot — in most cases, changes are within a few hundred dollars of income. But it’s something to be aware of especially for small business owners or even for entrepreneurs who have to file their estimated taxes on a quarterly basis.

Minimum Wage

While the Federal minimum wage doesn’t appear to be moving any time soon, there are still state-level increases to consider.

Last year, 17 states increased minimum wage. That’s up to 19 this year, with the highest minimum wages seen in Massachusetts and Washington, tying at $11 per hour. Alaska, Florida, Missouri, Montana, New Jersey, Ohio, and South Dakota have automatic increases based on their respective indexes.

Pay attention to your city, as well: cities like San Diego, San Jose, and Seattle are slated to see higher minimum wages on a local level.

Retirement Contributions and Limits

Any self-employed individual has to take special care to plan for retirement, and that means knowing what’s going on in the world of retirement accounts.

SurePayroll has a list of the changes you’ll need to be aware of in 2017—which is to say, very little. In fact, the big change this year is that there aren’t many big changes…which may affect your retirement plans if you’ve been counting on them.

This hits on another interesting point: although financial changes loom in politics, most small business owners will want to continue on as they have been, making filings as expected. It’s only when the changes are made official and enacted into law that you’ll want to make any hard decisions regarding your small business.

A Shifting Political Landscape

Since 2009, the U.S. has been led by Barack Obama. There’s one more change we can’t ignore here, as Donald Trump comes into office, flanked by political support in Congress.

If the only constant in life is change, then small businesses will want to watch political stories with keen interest in 2017. Changes to the Affordable Care Act—perhaps even dismantling it—loom in Congress. Small businesses like yours will be affected.

With the stability of a two-term president, small businesses have come accustomed to the kinds of shifts they might see year-to-year. With a new administration, new policies are to be expected, though it’s highly possible that any changes will officially place in 2018 and further down the line. Most notably, the new administration has promised changes to maternity leave, the Affordable Care Act, and business regulations.

Whatever your political leanings, one thing is clear: small business owners on either side of the aisle will need to keep an eye on headlines to know what’s in store for them for 2017 and beyond.